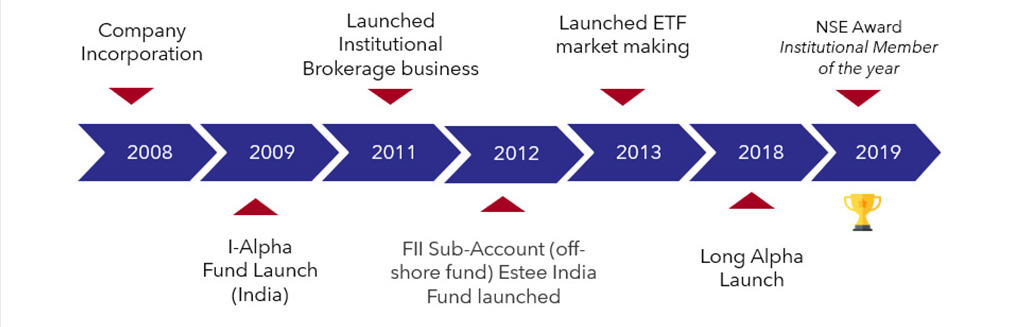

Timeline

History : The Indian market has evolved rapidly over the past decade and increasing sophistication amongst players, regulators, customers, and exchanges has paved the way for market-wide adoption of latest technology and an increase in market depth, breadth, and efficiency. Recognizing the benefits of algorithmic trading, the Indian stock market regulator SEBI and NSE/BSE offered direct market access (DMA) in India in August 2008. The first algorithmic trading product was offered by Lehman Brothers on Aug 4, 2008. There was some skepticism initially; however, market participants saw the benefit of the improved infrastructure and the perceptions have significantly changed since then. NSE, BSE, MCX and MCX-SX provide co-located services and there are well over 100 brokers co-located with these exchanges.